The payroll department of your employer or former employer should be saving important tax information such as w 2s. I need a copy of my w 2 or 1099 turbotax does not have a copy of your w 2the wage tax statementissued to you by your employer nor does turbotax have copies of your 1099s.

Most people get their w 2 forms by the end of january.

How to get w2 from previous employer 2018.

How do i get a copy of my 2018 w 2i cant find my copy.

Ask for the w 2 to be sent to you.

Check that your employer previous or current has mailed the form.

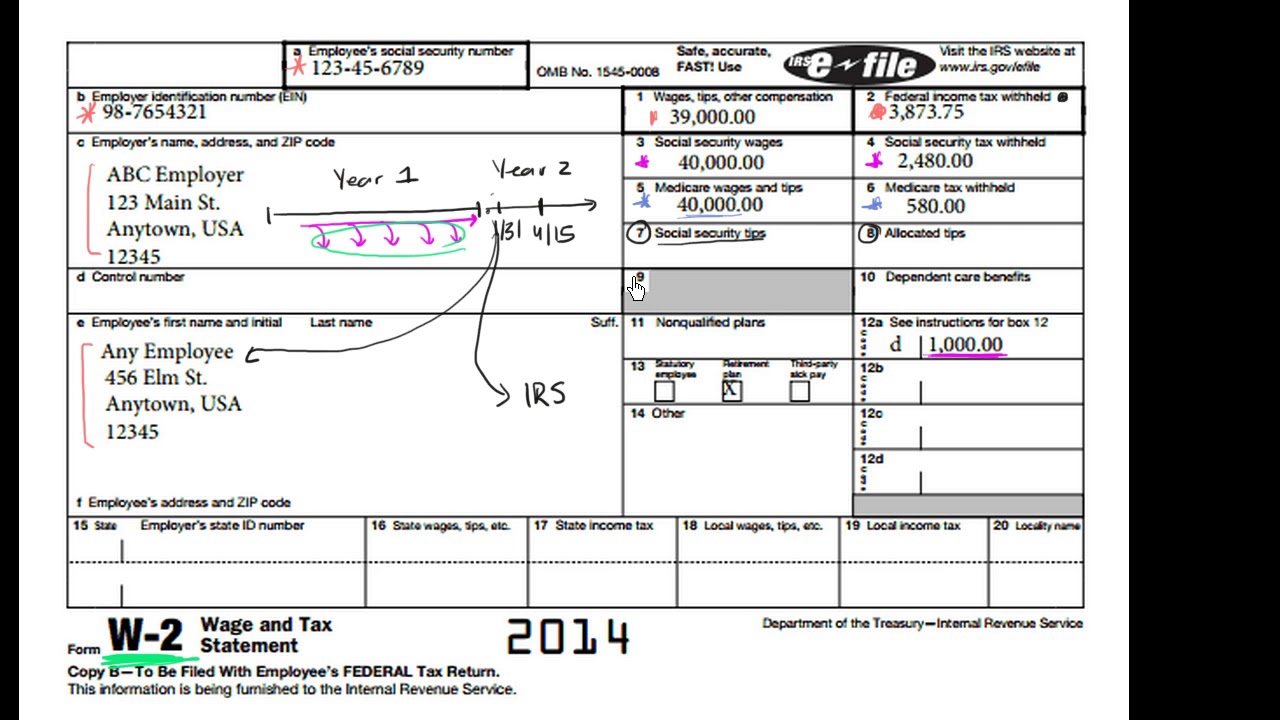

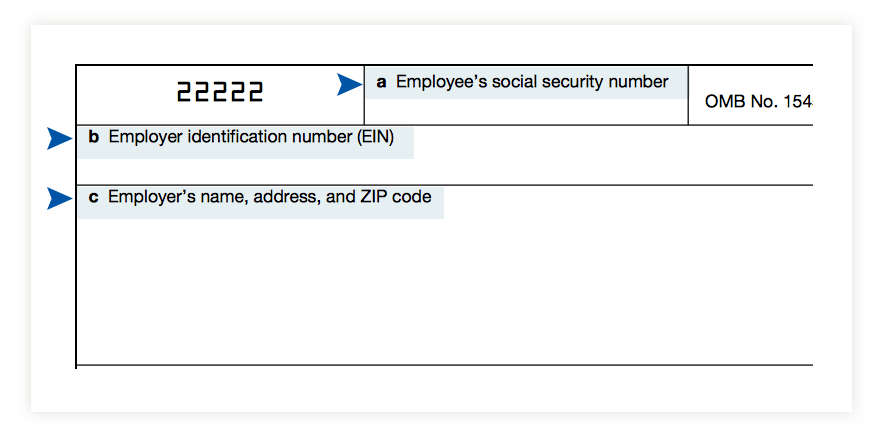

For line 4 enter the tax year of the estimated w 2 in first section and the type of form you are estimating in this case form w 2 in the second section.

For line 5 enter your employers or other payees name and complete address.

If the above methods dont work have no fear.

Be sure to confirm the date it was sent too.

Form w 2 wage and tax statement shows your income and the taxes withheld from your pay for the year.

Contact the irs if you do not receive your w 2 by february 15 the irs will contact your former employer on your behalf to request it.

You may be able to obtain your w2 by contacting your payroll administrator.

Speed up the process.

Allow 75 calendar days for us to process your request.

The easiest way to get a copy of a lost w 2 is to contact the employer who issued it.

Get your w 2 from previous employer.

Employers have until january 31 of the year taxes will be filed to send a w 2 to employees.

How to get a w 2 from a previous employer reach out to your former employer.

Confirm your mailing address and details right down to the spelling of the street name.

Ask your former hr representative for a copy.

Here are a few things you can do to try and speed up the process to get your refund.

Sometimes w 2 forms from employers are not sent or they get lost in the mail.

Please see irs tax tip 2018 30 february 27 2018 irs can help taxpayers get form w 2 for updated information.

Complete and mail form 4506 request for copy of tax return along with the required fee.

Irs tax tip 2016 12 february 3 2016.

If youre missing your w 2 contact your employer before contacting the irs.

If you cant get your form w 2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the irs for a fee.

If your employer does not produce your w 2 form or if you cannot contact your employer because the company is no longer in business ask the irs to intervene.

Contact the irs directly.

/understanding-form-w-2-wage-and-tax-statement-3193059-v4-5bc643e646e0fb0026d3aafc-5c0ab974c9e77c000168e8d4.png)

No comments:

Post a Comment